Our Sponsors and Partners

Auditronix

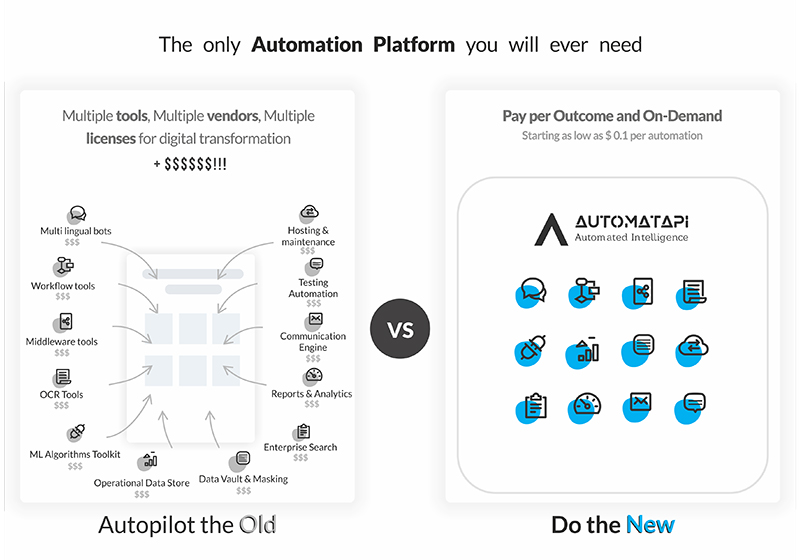

Automation

Avendus

Avendus Capital

Avendus Capital Pvt. Ltd is a leading financial services firm, which alongwith its associates, provides customised solutions in the areas of financial advisory, equity capital markets, alternative asset management and wealth management. The firm relies on its extensive track record, in-depth domain understanding and knowledge of the economic and regulatory environment, to offer research based solutions to its clients that include institutional investors, corporations and high net worth individuals/families. In recent years, Avendus Capital Pvt. Ltd. has consistently been ranked among the leading corporate finance advisors in India and has emerged as the advisor of choice for cross-border M&A deals, having closed around 34 cross-border transactions in the past 5 years. Avendus Wealth Management Pvt. Ltd. caters to investment advisory and portfolio management needs of Family offices and Ultra High Networth Individuals / families, spanning all asset classes. Headquartered in Mumbai, the firm has offices in New Delhi and Bangalore.

Avendus Capital, Inc (US) and Avendus Capital (UK) Pvt. Ltd. located in New York and London respectively are wholly owned subsidiaries of Avendus Capital Pvt. Ltd offering M&A and Private Equity syndication services in the respective regions. Avendus Capital, Inc (US) also provides wealth management services in select jurisdictions in USA. For more information, please visit www.avendus.com

Avenor Aviation

Avigo Capital Partners

Avigo Capital Partners is an Indian private equity fund manager with a focus on Private Equity Investments in the SME sector in India. Avigo has over USD 365 million under management and has successfully raised and invested two funds (The Avigo SME Fund I and the Avigo SME Fund II). Avigo is currently making investments from the USD 240 million Avigo SME Fund III. Avigo has established its credentials and demonstrated a differentiated investment strategy of supporting SME companies in their growth phase through more than 25 investments in over 15 companies over the past 7 years.