Our speakers

Harsh Mariwala, Founder and Chairman, Marico

Mr. Mariwala leads Marico Limited as its Chairman. He is also Chairman & Managing Director of Kaya Limited.

Mr. Mariwala’s passion for innovation enthused him to establish the Marico Innovation Foundation in 2003 which works towards nurturing innovations in India. In 2012, Mr. Mariwala started ASCENT Foundation, a peer-learning entrepreneurial platform.

Sharrp Ventures is the Family Office of the Harsh Mariwala Family. He also founded the Mariwala Health Initiative (MHI) in 2015, with the philanthropic aim of giving back to society.

Mr. Mariwala was recently bestowed the EY Entrepreneur of the year award 2020 for India which is the world's most prestigious business award for entrepreneurs.

Harsh Pais, Partner - Corporate, Private Equity and M&A, Trilegal

Harsh Pais is a partner in the Trilegal's corporate practice, focusing on M&A,private equity and funds. In the course of his practice, Harsh advises institutions and corporations extensively on cross border transactions, structured investments and financings.

Harsh also advises sponsors in structuring and raising private equity/investment funds, and acts on transactional and regulatory matters for financial institutions, including banks, regulated non-banking finance companies (NBFCs) and foreign institutional investors (FIIs).

Harsh Pais, Partner, Trilegal | @TrilegalLaw

Harsh Pais is a Partner of Trilegal, and is part of the corporate practice group, focusing on M&A and private equity. In the course of his practice, Harsh advises institutions and corporations extensively on cross-border acquisitions, joint ventures and structured investments. Harsh also advises sponsors and LPs in the context of private equity/investment funds. Aside from his transactional practice, Harsh also provides governance, securities and crisis-management advice.

Harsh is ranked and recognized by Chambers & Partners, IFLR and RSG as a leading lawyer for M&A and Private Equity in India.

@harshpais

Harsh Parekh, Co-Founder and Whole-time Director, API Holdings

Harsh Parekh is the Co-Founder and Whole-time Director of API Holdings, India's largest digital health platform. The group has businesses and brands like PharmEasy, Retailio, DocOn, Aknamed, and Thyrocare.

Harsh finished his graduation in computer engineering from DJ Sanghvi College of Engineering and post that he did his MBA in Marketing from NMIMS in 2009-2011. He was the founder member of Ekagrata (NGO for Children's education), ACM (International student body), and Secretary of Rotaract Club. He started his career ITC and then joined Bharti Airtel as part of Young Leader Group. After briefly working for one year, he decided to start the entrepreneurship journey with two friends. They are the first health tech unicorn and recently created history by acquiring the listed company Thyrocare.

Harsh looks after the Channel and Platform Business and has been responsible for scaling the business over the last 9 years. He leads the group's efforts in retailer, hospital, fintech and brands. He has recently been featured in the Fortune 40 under 40 lists and is now an active angel investor in new-age companies.

Harsh Shah, CEO, IndiGrid

Mr. Harsh Shah has extensive experience in infrastructure sector across bidding, financing, operations, M&A and regulatory policy. Mr. Shah was instrumental in setting up IndiGrid, India’s first Infrastructure Investment Trust (“InvIT”) in the power transmission sector, where he currently serves as the Chief Executive Officer and Whole-time Director. He is also a member of the SEBI Advisory Committee for InvITs and REITs and Financial Markets committee of CII. Previously, Mr. Shah served as the Chief Financial Officer at Sterlite Power Transmission Limited. Prior to joining Sterlite, he has worked with Larsen & Toubro Limited, L&T Infrastructure Finance Company Limited and Procter & Gamble International Operations Pte. Limited.

Mr. Shah holds a Master’s degree in Business Administration from the National University of Singapore and a Bachelor’s degree in Electrical Engineering from the Nirma Institute of Technology, Gujarat University.

Harsh Shetty, CEO, Central Square Foundation | @CSF_India

Harsh Shetty is the CEO of Central Square Foundation. Harsh has 16 years of experience in diverse sectors such as education, healthcare, investment banking and technology.

His last stint in education was with his entrepreneurial venture Firefish, an education technology products company that creates online education programmes for students across India. Before founding Firefish, Harsh worked at the Pratham Education Initiative in a variety of roles including leading new initiatives, operations, business development and advocacy.

Prior to joining CSF, Harsh was associated with World Health Partners, where he worked extensively with the central and state governments to improve delivery of health services. He has also worked with Living Good in Kenya and Uganda, i2 Technologies (now JDA) and Citigroup.

Harsh has an undergraduate degree in Engineering from the Indian Institute of Technology- Madras and an MBA from the Tuck School of Business at Dartmouth where he graduated as a Tuck Scholar with High Distinction.

Harsh Singhal, Managing Director, CDPQ

Harsh Singhal is responsible for managing relationships with external asset managers in India equity markets. In collaboration with CDPQ’s investment teams, he develops and manages the organization’s strategic and institutional relationships in India to implement its equity markets strategy in the region. He also leads CDPQ’s office in New Delhi, where he is based.

Mr. Singhal joined CDPQ in 2017 as a Director in the Growth Markets team. Previous to that, he was the Senior Investment Officer with International Finance Corporation (IFC) in New Delhi. He led the organization’s investment and portfolio management projects involving growth equities, deb t financing and venture capital activities. He also worked for Boston Consulting Group and PricewaterhouseCoopers, where he worked on various investment structuring, mergers and acquisitions and business improvement projects.

Mr. Singhal is a Fellow of the Institute of Chartered Accountants of India and holds a Master’s of Business Administration (MBA) from the Indian School of Business, Hyderabad. He also represents CDPQ at the Indian Private Equity & Venture Capital Association (IVCA).

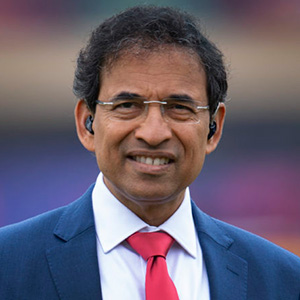

Harsha Bhogle, Indian Cricket Commentator, Sports Broadcasting Journalist, Author

Harsha Raghavan, Managing Director, Candover Private Equity

Harsha joined Candover in 2008 from Goldman Sachs where he was an Executive Director and co-head of GS PIA-India. He previously worked at Indocean Chase Capital, one of India earliest PE funds, and was also co-founder & CEO of a Silicon Valley start-up company.

Harsha is an Indian national and holds MBA and MS in Industrial Engineering degrees, both from Stanford University, and a BA from UC Berkeley. He is based in Mumbai.

Harshad Lahoti, Founder & CEO, ah! Ventures

Currently at the helm of four companies in the Financial Services & Consultancy space, creating and growing businesses is not new for Harshad. He made his beginnings as a Management Executive with Larsen & Toubro, where he was assessed to be a high level performer and selected for their esteemed Management Leadership Program. His passion for finance, however, called him to move on to creating his own investment advisory and wealth management company Intercontinental Investments (2005), followed by Excelman India (2006). Further, with his interest in investment banking and desire to help early-stage ventures, Harshad founded ah! Ventures (2009) and CLUB ah! network (2012). In the past 10 years, Harshad has grown his ventures into reputed, self-sufficient businesses that fuel their own growth.

While his investment banking knowledge gives him an edge in evaluating businesses and investment opportunities, it is his extensive experience in creating super specialised, highly motivated teams and lean, optimised workflows and processes that Harshad is known best for. Harshad is known to be an astute problem solver and brilliant negotiator with the ability to think on his feet, while being meticulous and detailed in everything he undertakes. Among other things, he brings to the table the ability to create and build brands and bring about winning partnerships capable of handling whatever curveball the market throws at them.

Besides his interest in finance & investments, Harshad is also deeply involved as a director with the Ajit Lahoti Charitable Foundation, one of Pune’s leading charitable institutions helping Chronic Renal Failure patients minimize their hardships by better kidney disease management. He is a Fellow Member of Aspen’s India Leadership Initiative, a unique values-based leadership program designed to help leaders move from “success to significance”. He has invested in over 40+ startups till date and is a regular speaker at many startup events in India & abroad.

Harshad travels extensively, loves yoga & salsa dancing and lives in Mumbai & Pune.