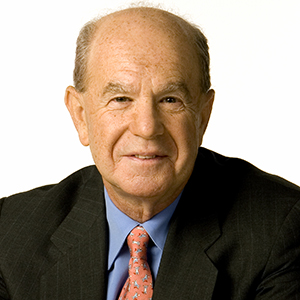

Professor Edward I. Altman, Professor of Finance, NYU Stern School of Business. Dr. Altman is also Co-Founder and Senior Advisor to the SME Credit Analytic Firm, Wiserfunding, Ltd.

Edward I. Altman is the Max L. Heine Professor of Finance at the Stern School of Business, New York University. He is the Director of Research in Credit and Debt Markets at the NYU Salomon Center for the Study of Financial Institutions. Prior to serving in his present position, Professor Altman chaired the Stern School's MBA Program for 12 years. He has been a visiting Professor at the Hautes Etudes Commerciales and Universite de Paris-Dauphine in France, at the Pontificia Catolica Universidade in Rio de Janeiro, at the Australian Graduate School of Management and MacQuarie in Sydney, University of Western Australia in Perth, Luigi Bocconi University in Milan and CEMFI in Madrid. Dr. Altman was named to the Max L. Heine endowed professorship at Stern in 1988.

Dr. Altman has an international reputation as an expert on corporate bankruptcy, high yield bonds, distressed debt and credit risk analysis. He was named Laureate 1984 by the Hautes Etudes Commerciales Foundation in Paris for his accumulated works on corporate distress prediction models and procedures for firm financial rehabilitation and awarded the Graham & Dodd Scroll for 1985 by the Financial Analysts Federation for his work on Default Rates on High Yield Corporate Debt and was named "Profesor Honorario" by the University of Buenos Aires in 1996. He is currently an advisor to the Centrale dei Bilanci in Italy and to several foreign central banks. Professor Altman is also the Chairman of the Academic Advisory Council of the Turnaround Management Association. He received his MBA and Ph.D. in Finance from the University of California, Los Angeles. He was inducted into the Fixed Income Analysts Society Hall of Fame in 2001, President of the Financial Management Association (2003) and a FMA Fellow in 2004 and was amongst the inaugural inductees into the Turnaround Management Association’s Hall of Fame in 2008. In 2005, Prof. Altman was named one of the “100 Most Influential People in Finance” by the Treasury & Risk Management magazine. He also received an Honorary Doctorate from Lund University, Sweden in May 2011.

Professor Altman was one of the founders and an Executive Editor of the international publication, the Journal of Banking and Finance and Advisory Editor of a publisher series, the John Wiley Frontiers in Finance Series. He has published or edited two-dozen books and over 150 articles in scholarly finance, accounting and economic journals. He was the editor of the Handbook of Corporate Finance and the Handbook of Financial Markets and Institutions and the author of a number of recent books, including his most recent works on Bankruptcy, Credit Risk and High Yield Junk Bonds (2002), Recovery Risk (2005), Corporate Financial Distress & Bankruptcy (3rd ed., 2006) and Managing Credit Risk (2nd ed. 2008). His work has appeared in

many languages including French, German, Italian, Japanese, Korean, Portuguese and Spanish.

Dr. Altman's primary areas of research include bankruptcy analysis and prediction, credit and lending policies, risk management and regulation in banking, corporate finance and capital markets. He has been a consultant to several government agencies, major financial and accounting institutions and industrial companies and has lectured to executives in North America, South America, Europe, Australia-New Zealand, Asia and Africa. He has testified before the U.S. Congress, the New York State Senate and several other government and regulatory organizations and is a Director and a member of the Advisory Board of a number of corporate, publishing, academic and financial institutions. He has been Chairman of the Academic Council of the Turnaround Management Association since 2002.

Dr. Altman is Chairman Emeritus and a member of the Board of Trustees of the InterSchool Orchestras of New York and a founding member of the Board of Trustees of the Museum of American Finance.