A-Raise

Start-ups from around the globe are joining the emerging Unicorn/Decacorn board. It’s time to supercharge more people to pursue their passion and create the Next Revolution. As the industry continues to witness capital inflow, the growth trajectory for start-ups is unstoppable.

However, the tricky part is not just to equip start-ups on aspects of valuation and fundraising but also to create a solid understanding of the VC/PE ecosystem and the latest trends thereof; understand the intricacies of the perfect term sheet, and arrive at the optimal quantum and mix of capital raising.

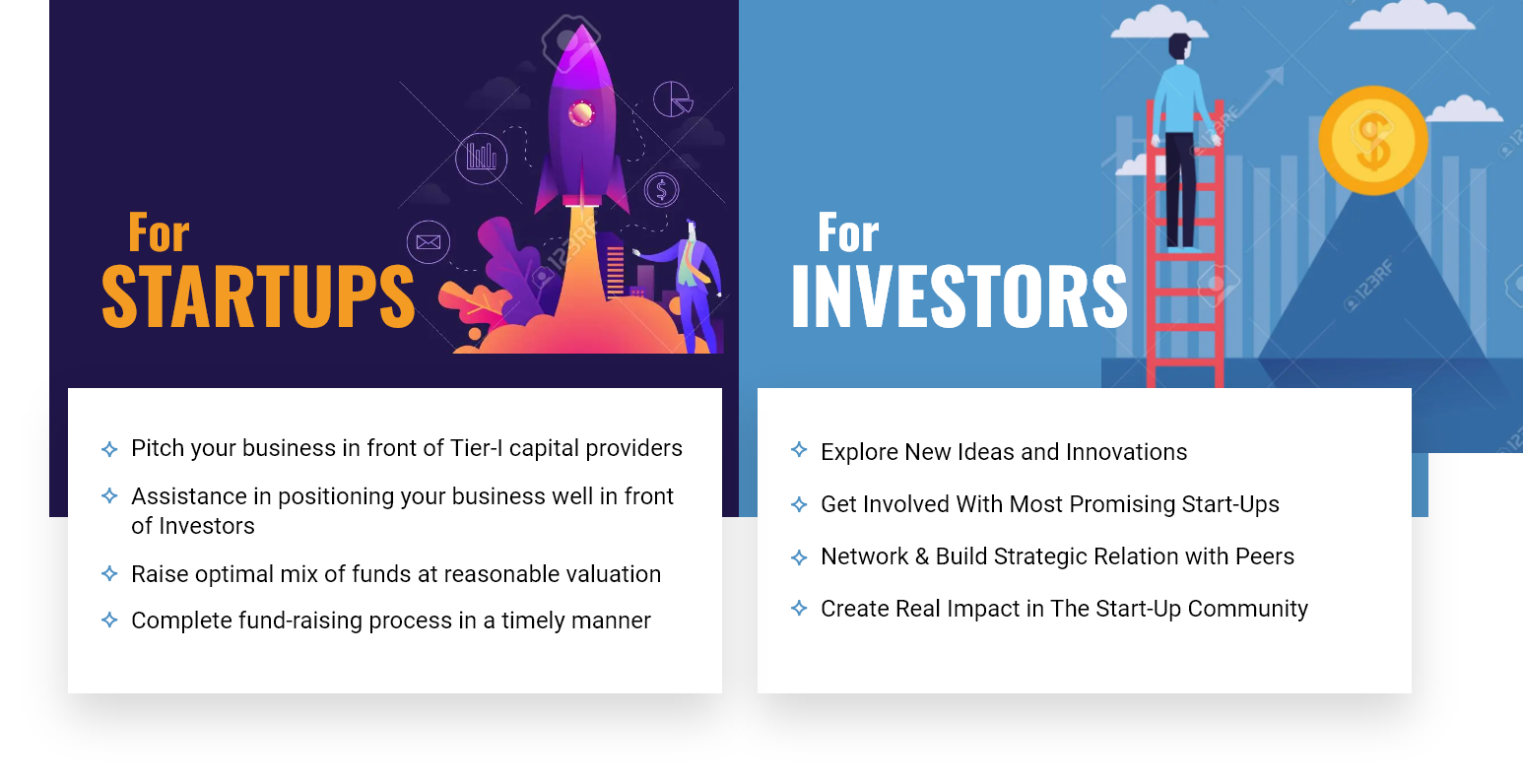

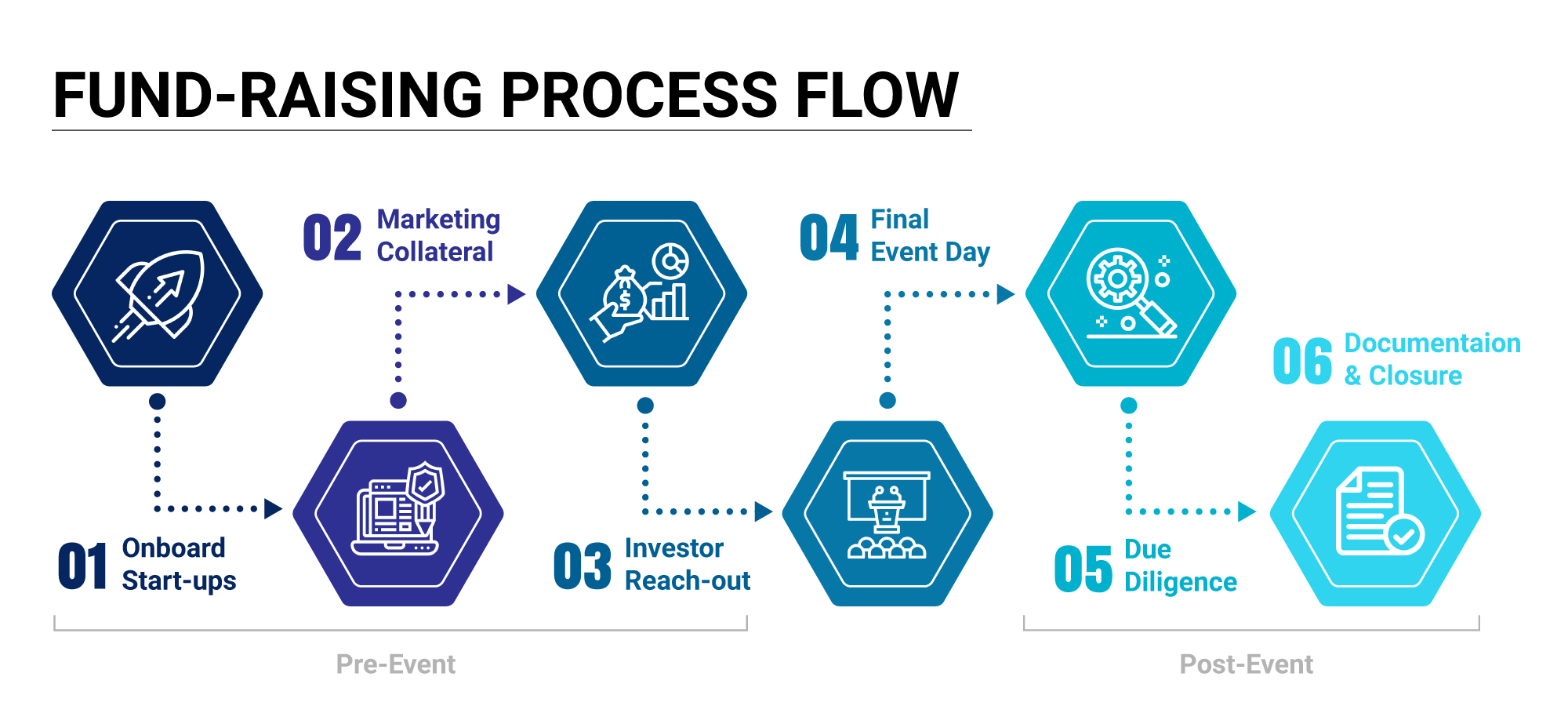

Avener Capital in association with Mint and VCCircle, is launching 'A-Raise' - a unique platform connecting start-ups in the Series A - Series B stage with likeminded investors. If you are a confident start-up founder aiming to accelerate to the future, this platform is just for you. You can pitch your ideas & innovations to investors and skyrocket your businesses. As an investor, this unified platform allows you to explore new ideas and identify the right business plans & founders curated and aligned to your beliefs and future growth.

The rise of PE & VC Investments in 2022

Masterclass on Deciphering the Art of Raising Next Rounds

29th September, Jio convention center, Mumbai

Given the series of Unicorns established in recent times, every founder is lured by the start-up dream. However, those in the market understand how and why valuing their start-up ventures is notoriously hard. Further, the primary dilemma that founders find themselves in is deciding upon the right amount to raise and when—

- Raise too much money, and risk over-diluting yourself

- Raise too little, and risk having too few resources to scale to the next level.

Nonetheless, the ask is how to — find the fundraising sweet spot for YOUR start-up; attract venture capital for YOUR business; aligning your vision with the vision of the investors.

Avener Capital’s masterclass in association with VCCircle, will equip start-ups on aspects of valuation and fundraising. This exclusive session will create a solid understanding of the VC/PE ecosystem and the latest trends thereof; understand the intricacies of the perfect term sheet, and arrive at the optimal quantum and mix of capital raising.

New Valuation Techniques

Achieving Optimal Dilution

Fundraising Process and System

Key Documentation and Legal Aspects

Agenda

-

5:00 PM – 5:30 PM

Introduction to PE/VC Fundraising - a Start-Up's perspective

Topics covered:

- Journey of fund raising

- Fundraising strategy

- Pitfalls and challenges

Manish Lunia, Co-Founder, FlexiLoans.co

-

5:30 PM – 6:15 PM

Fund raising for Start-up companies

Topics Covered:

- Timeline for successive fund raise

- Optimal Dilution

- Fund raising process and system

Shivam Bajaj, Founder & CEO, Avener Capital

-

6:15 PM – 7:00 PM

Challenge of Scaling in the Times of Cautious Investments

Topics Covered:

- What do investors look for?

- Blueprinting for the Series B round and beyond

- Common pitfalls

Vikram Gawande, Investor, Blume Ventures

-

3:30 PM – 3:40 PM

Welcome Address

Introductions and Agenda run through

-

3:40 PM – 4:30 PM

Start-Up Huddle

Each start-up to be briefed on the important aspects of pitching

-

4:00 PM – 4:30 PM

Investor Briefing

Each Investor to be briefed on each of the start-up pitching on the day, and the evaluation framework

-

4:30 PM – 7:00 PM

Pitch Sessions

2 Pitching Rooms with like minded investors grouped together

Each Pitch session to be of 20 mins each including Q&A

Pitch feedback to be collected on a pre-designed evaluation form circulated with all investors

-

7:00 PM – 8:00 PM

Investor Lounge

Dinner and Drinks

Masterclass Trainers

Manish Lunia

Co-Founder, Flexiloans.comShivam Bajaj

Founder and CEO, Avener CapitalVikram Gawande

Investor, Blume VenturesSpeakers 2022

Kanika Mayar

Partner, Vertex VenturesAnand Datta

Principal, Nexus Venture PartnersGaurav Ranjan

Vice President, Prime VenturesVineet Agarwal

Investor, Antler IndiaParag Dhol

General Partner/Venture Capital, Athera Venture PartnersUmang Agarwal

Principal, Eight Roads VenturesKanishk Tyagi

Investor, Alpha Wave GlobalSumit Keshan

Managing Partner, Venture Capital | Wipro Consumer Care - VenturesVS Kannan Sitaram

Partner, Fireside VenturesDo you have any queries?

Drop us a line and we will call you.